This Pivot points+vwap scalping strategy can make you rich if you use a little bit logic with it.

According to us even ₹25,000 will be less worth for this scalping strategy but its free for you.

We know that you all are getting mislead by many youtubers and traders. But this scalping strategy is ofcourse different than others. Just 2 indicators and a small logic, thats it.

Let’s start the scalping strategy. Read each line and observe every step carefully, important things are in bold.

1.Setup tradingview chart:

First of all go and search tradingview on google and make sure you use it on google/browser and not its app.

If you don’t know how to use tradingview, check this ‘blog‘ altogether with our strategy.

Search any stock and open its advanced chart and make sure its price should be more than ₹1500, for this case we are taking TITAN as example as its price is currently ₹2000+.

Now, change the line chart to candle chart and set the chart to 1 min, which means each candle will be of 1 min each and now your chart should look like below image.

2.Setup the indicators on charts:

Search and apply ‘Pivot points standard’ and ‘Volume weighted average price'(VWAP) indicators on chart and it should look like below.

3.Some settings in indicators:

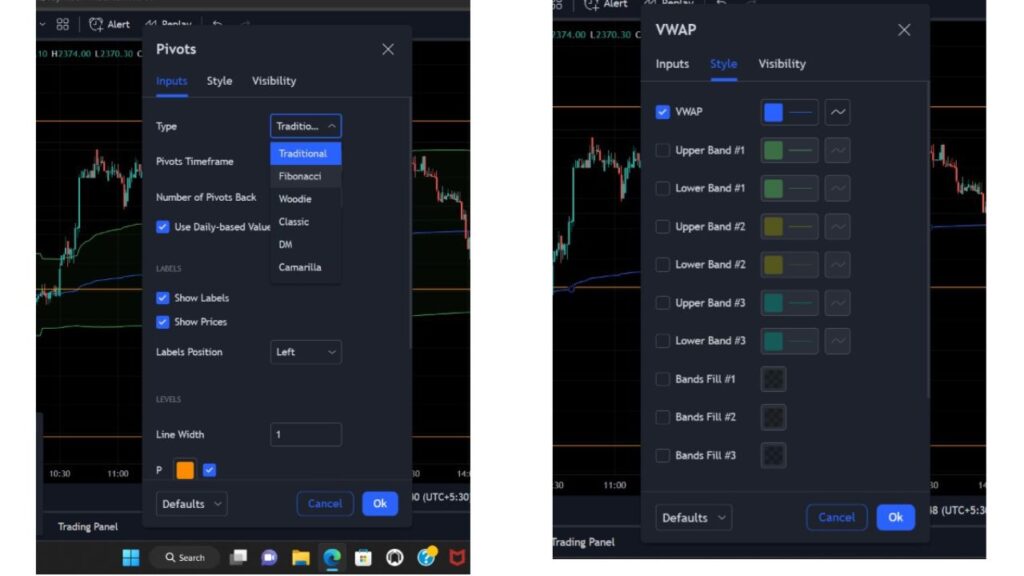

Before applying the strategy there are some changes that need to be made in the indicators. When you go to the pivot point below the name of the stock, you will find a ‘setting’ icon and after that you will find ‘traditional’, just change it to ‘fibonacci’ and go to vwap settings and in ‘style’ disable everything except vwap.

For understanding better, check the photo below.

4.When to take BUY entry:

Conditions:

*Candle should break and close above any pivot line.

*Entry Candle while closing should be above VWAP.

*Timing for entry should be strictly between 9:30 to 10:30 am.

Stoploss:

*Little below the low of previous 2 candles as you can see in above photo.

*On basis of photo above, entry is at ₹2365 and previous 2 candles lowest price is ₹2360, thats why we kept stoploss at ₹2359.50.

Target:

*1:1 or 1:1.5 target which means either same points profit as much as stoploss or half more than that.

*As per photo above, difference between entry and stoploss price is 5 points so target you can take 5 to 7.5 points upside as you can see in photo.

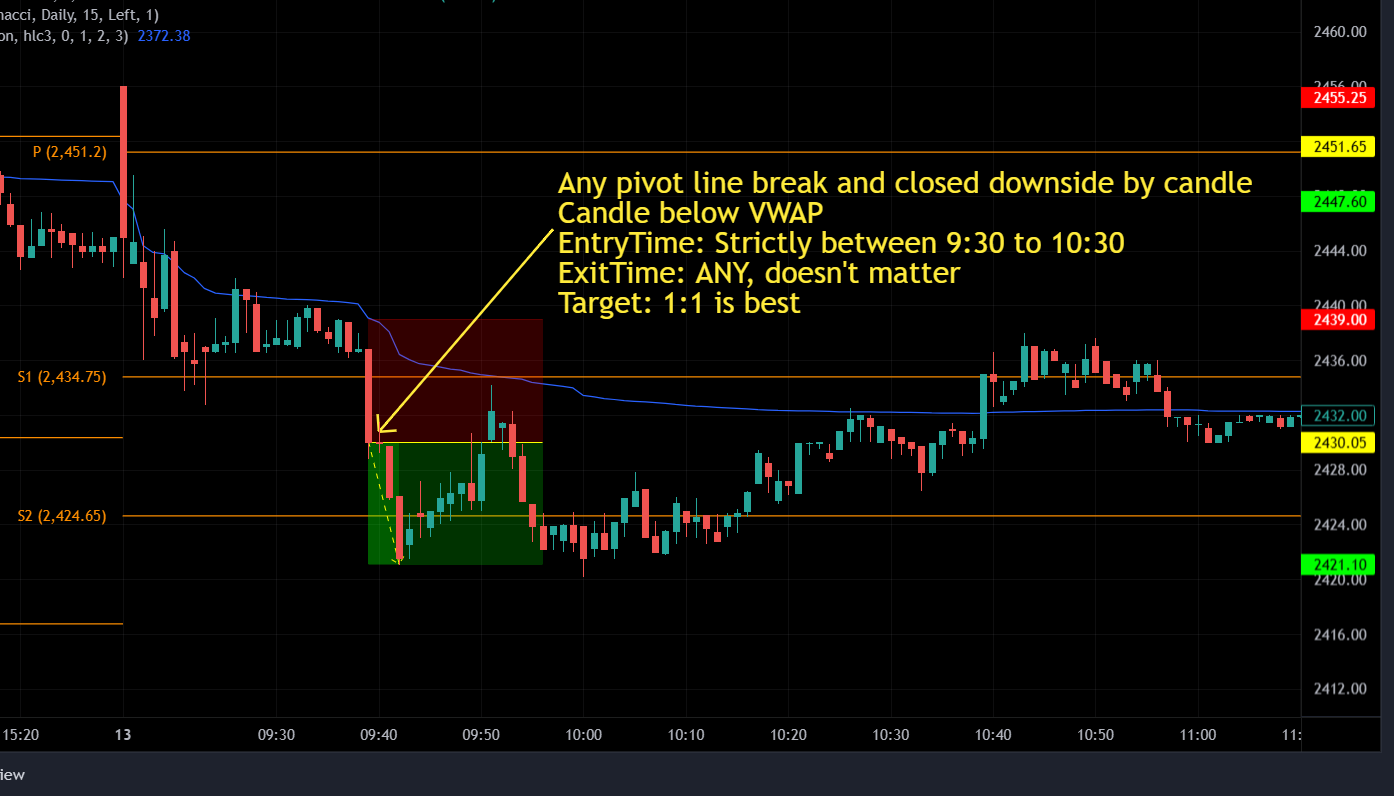

5.When to take Sell Entry:

Conditions:

*The Candle should break and close below any pivot line.

*While closing candle should be below VWAP.

*Time for entry strictly between 9:30 to 10:30 am.

Stoploss:

*Little above the high of previous 2 candles of entry as you can see in above photo.

*On basis of photo above, entry is at ₹2430 and previous 2 candles highest price is ₹2438.50, thats why we kept stoploss at ₹2439.

Target:

*1:1 or 1:1.5 target which means either same points profit as much as stoploss or half more than that.

*As per photo above, difference between entry and stoploss price is 9 points so target you can take 9 to 12 points upside as you can see in photo.

Some important points to note for this scalping strategy accordingly:

*This is a scalping strategy, entry and exit will be fast and profits and losses will be small.

*Entry time should be strictly between 9:30 am to 10:30 am, not before and not after that.

*Exit time does not matter, you can wait for as long as it takes to either hit target or stoploss.

*Do backtest the strategy on the stock before you trade, some stocks will not suit on this strategy.

*This strategy is for educational purposes, please consult your financial advisor before trading.

*If you want direct updates regarding the entry and exits, you can join our whatsapp group where we give updates, so you don’t have to see charts all the time if you don’t have enough time for it.

*How to join our whatsapp group for FREE? ‘Whatsapp‘ us to know the free joining process.

Watch the complete strategy explanation with live backtesting in HINDI on our youtube channel:(Strategy video below)

Follow our social media platforms:

Youtube: BSW stocks and finance

Check our other articles as well ‘Top 10 best discount brokers in India 2023‘, ‘Stock market holidays 2023‘ and ‘Upcoming IPOS in 2023‘

Do comment below how you liked the strategy

Thanks Everyone

This is nice, liked the strategy

Pingback: Top 10 Full service brokers in India in 2023 - Bazaar Badshah

Pingback: Recent/Active IPOs, 2023 New listings Updated - Bazaar Badshah

Pingback: Adani Enterprises FPO 2023, Complete review - Bazaar Badshah

Pingback: Top 10 books for stock market beginners - Bazaar Badshah

Pingback: 5 Tradingview indicators you didn't know about - Bazaar Badshah