Which Indian Discount brokers are best for you in 2023?

We know that being in the market with a good broker is very essential for everybody , and with the rise of scams and misleadings, you should stick with the top brokers with a decent review, good quality services and reliablility, Hence, here are the top 10 discount brokers in india in 2023.

We will start the list from the highest rated:

1. Zerodha

Brokerage Charges:

*All equity delivery investments (NSE, BSE) are absolutely free — ₹ 0 brokerage.

*Flat ₹ 20 or 0.03% (whichever is lower) per executed order on intraday trades across equity, currency, and commodity trades. Flat ₹20 on all option trades.

*All direct mutual fund investments are absolutely free — ₹ 0 commissions & DP charges.

Overall Review:

*Overall zerodha is considered to be the top discount broker according to us because of a huge client base of around 6 million+ and good user interface of app(Kite) for trading, overall it is rated (4.2/5) by users. It is in the broking business since 2010. And yes, its considered best in top 10 discount brokers in india

2. Upstox

Brokerage charges:

*Zero commission* on Mutual Funds and IPO

*₹20* per order on Equity, F&O, Commodity and Currency

Overall Review:

*According to us upstox comes at the second spot in top 10 as it is backed by Ratan tata as well, Upstox client base is also around 6 million (60 lakh) with good user interface and it was also one of the sponsors of IPL. It is in the broking business since 2009. It is rated as (4.2/5) by users.

3. Angel One

Brokerage charges:

*Zero brokerage on Equity Delivery Trading & ₹20/order Flat Brokerage for Intraday, F&O, Currencies & Commodity.

Overall review:

*Angel one also known as Angel broking is in the broking business since 1997, its customer base is around 4.1million (41 lakhs) and its a at the top 3rd position according to us because it doesn’t only have hands in discount broking but also in full service broking makes its services better and also the user interface is pretty cool. It is rated as (3.8/5) by users.

4. Paytm Money

Brokerage charges:

*2.5% of turnover or Rs. 15/- per Executed Order, whichever is lower when you take delivery of shares in your demat account.

*Minimum of 0.05% of turnover or ₹15 when there is no debit/credit of shares in your demat account.

*Minimum of 0.02% of turnover or ₹15 per executed order on intraday and carry forwarded trades in equity Futures and ₹15 per executed order in Options

Overall review:

*Paytm money seems a good choice for those who want more lower brokerage than 20 rupees, even though paytm money is new in market but its father company ‘Paytm’ is since a long time is very reliable. Paytm money comes with a good user interface and as its new its client base is around 0.6 million (6 lakh), it is rated as (3.2/5) but these numbers can change once it grows more

‘Click here‘ to open a Free demat account in Paytm Money

5. Fyers

Brokerage charges:

*Zero brokerage for Equity Delivery, ETFs, Thematic & Mutual Funds

*₹20 or 0.03% per executed order, whichever is lower for intraday and F&O

Overall review:

*Overall fyers seems to be an okay choice according to us for trading, its user interface is okay, client base is around 0.1 million (1 lakh), it is rated as (4/5)

6. Groww

Brokerage charges:

*₹20 or 0.05% whichever is lower for equity/delivery

*₹20 flat per order in intraday and F&O

Overall review:

*Overall groww is an okay type of broker for trading according to us, its user interface is also okay, groww was started on 2016, its customer base is around 3 million (30 lakhs), it is rated as (4/5)

7. AliceBlue

Brokerage charges:

*0 in equity deliver

*₹15 per order in Intraday and F&O

Overall review:

*Alice blue offers a good service with a good user interface app for trading. It got pretty famous during lockdown and currently it seems at an okay position according to us. It was started on 2006 and currently has client base of around more than 1 lakh, it is rated as (4/5)

8.IIFL securities

Brokerage charges:

*₹20 flat for delivery, intraday and F&O per order

Overall review:

*We know that you are confused to see IIFL securities in discount broking segment, but yes they do offer this flat brokerage charges system, it has a customer base of more than 1 million (10 lakh), its user interface is not that good according to us for trading. It is rated as (2.6/5)

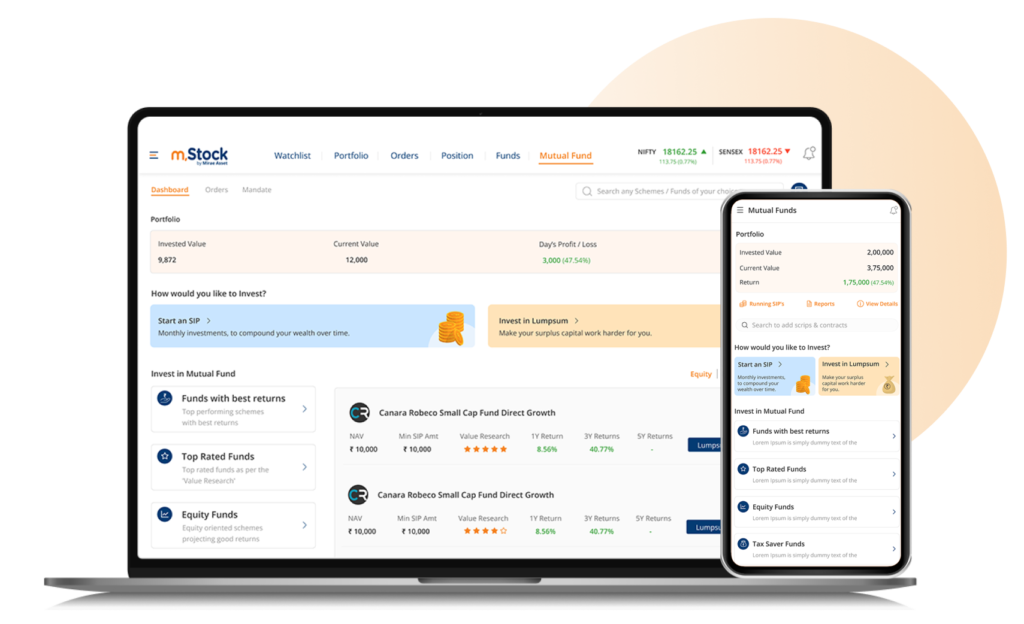

9.Mstock

Brokerage charges:

*₹999 one time for zero brokerage in every segment

*₹149 one time for unlimited delivery trades and ₹20 for intraday and F&O

Overall review:

*M stock would be preferred only if your trading volumes are in bulk so that you can save your brokerage money, its user interface is not that good according to us but its brokerage free plan is a reason behind its growth, its customer base is around 1 lakh and it is rated as(4.2/5)

10.Kotak securities

Brokerage charges:

*All types of intraday orders free, but if you carry forward any order as delivery then ₹20 per order

*0.025% or ₹20 whichever is higher in equity delivery

Overall reviews:

*Kotak sercurities is a well service offering discount broker, you also get advisory from them for free, also kotak securities is well known as its father is Kotak bank which is a big and reliable company, its user interface is not as good as zerodha and upstox but its okay according to us, its customer base is around 12 lakh (1.2 million) and it is rated as (4/5).

Watch Hindi explanation of this list on youtube:

So these are the top 10 discount brokers in India for 2023

While we suggest you to also have an account under both discount and full service brokers as they both are essential for you

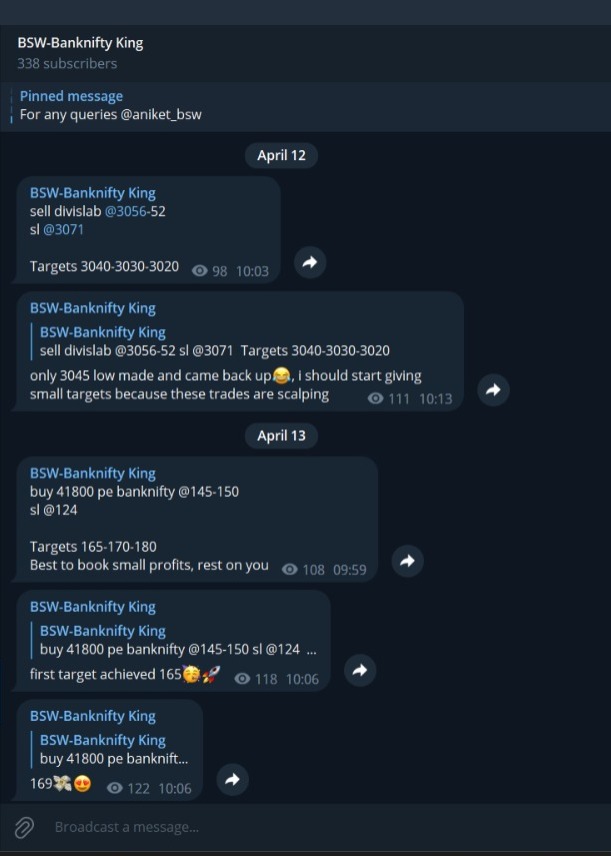

We have mentioned Paytm money account opening you can go and check above, once your account gets opened through there in paytm money, we will add you to a Private Whatsapp Group where you will get daily educational equity, intraday, options, nifty, banknifty and etc calls only for educational purposes. So, once account opened, do ‘whatsapp‘ us your name and id.

I hope you were able to understand which brokers will be best for you for 2023, do comment below your views if required.

Thank you

Pingback: Stock Market all holidays for 2023 - Bazaar Badshah

Pingback: Upcoming IPOS in 2023, Complete latest list - Bazaar Badshah

Pingback: This scalping strategy can make you rich - Bazaar Badshah

Pingback: Top 10 Full service brokers in India in 2023 - Bazaar Badshah

Pingback: Recent/Active IPOs, 2023 New listings Updated - Bazaar Badshah

Pingback: Top 10 books for stock market beginners - Bazaar Badshah

Pingback: Adani Enterprises FPO 2023, Complete review - Bazaar Badshah